Experiencing Insurance in a New Way.

Questions to Mr Rabe, Chairman of the VAV Board, concerning Corona and insurance. Mr Rabe, Corona has confronted the economy and society worldwide with a fierce challenge. As Chairman of the Board of VAV Versicherungs-AG, you certainly register how customers react to such events. Has the virus led to a change in people's attitude towards risks?

// Questions to Mr Rabe, Chairman of the VAV Board, about Corona and insurance. Mr Rabe, Corona has confronted the economy and society worldwide with a fierce challenge. As Chairman of the Board of VAV Versicherungs-AG, you certainly register how customers react to such events. Has the virus led to a change in people's attitude towards risks?

mr Rabe: A pandemic like the Corona virus is certainly exceptional, if only because the whole world was affected. In principle, however, such situations occur from time to time in various forms. Experience shows that this makes many people aware that risks do exist. As a rule, however, this is a short-term change in awareness.

// “In everyday life, people do not want to deal constantly and intensively with risks and other aspects of life that have negative implications.”

Mr Rabe: That's why this effect usually doesn't last too long. However, the Corona virus seems to have convinced many people that it makes a lot of sense to think about basic risk protection.

// What specific indications are there for this?

Mr Rabe: We know from the past that the basic need for security especially becomes stronger when a particular risk is covered extensively in the media. In the case of Corona, this is certainly the case in a special way. And we definitely sense that people are also concerned with this. When the economic situation takes a turn for the worse, it’s usually the case that people also save on insurance; both companies and private households then try to reduce their fixed costs. In fact, we’re currently registering only very low cancellation rates. This is a strong indication that insurance is an important component of life risk protection in the minds of customers.

// So the virus influences people's behaviour more than the economic crisis?

Mr Rabe: At least we can observe that the usual reactions of many people in economic crises and recessions with rising unemployment, namely to put all fixed costs to the test and also to save on insurance, have so far not been observed in the Corona crisis, or only to a certain extent. Insurance is, thus, apparently seen by many people as an important commodity. However, this is a snapshot, borne out of the fact that Corona is the dominant topic on the radio, the TV and the internet. We know from other earlier crises that this effect weakens over time. This can also be seen with other phenomena, such as natural hazards in summer, when there are floods and heavy hailstorms. When such topics are no longer in the media spotlight, they quickly disappear from people's awareness.

// VAV primarily insures private customers in Austria, from motor vehicle, household and other property insurance to liability and legal expenses insurance. Which protection has become particularly Mr Rabe: We were founded 40 years ago as a construction insurance company, as a partner of the Austrian construction industry. Today, we are, in fact, primarily a private customer insurer with further focal points in construction and in the segment of small and medium-sized enterprises. At present, our customers are particularly interested in the personal field of insurance. We’re noticing increased demand for accident insurance, for example, but also for legal protection. Of course, the economic crisis plays a role here, keywords being dismissal and labour law protection. In the summer, natural hazards insurance was added for seasonal reasons. This is certainly partly due to the fact that this year there were some weather conditions that led to natural hazards, i.e. storms, hail and heavy rain with flooded basements and streets.

// For many customers, service is just as important as the insurance product itself, from advice to the settlement of claims. How do you position VAV here?

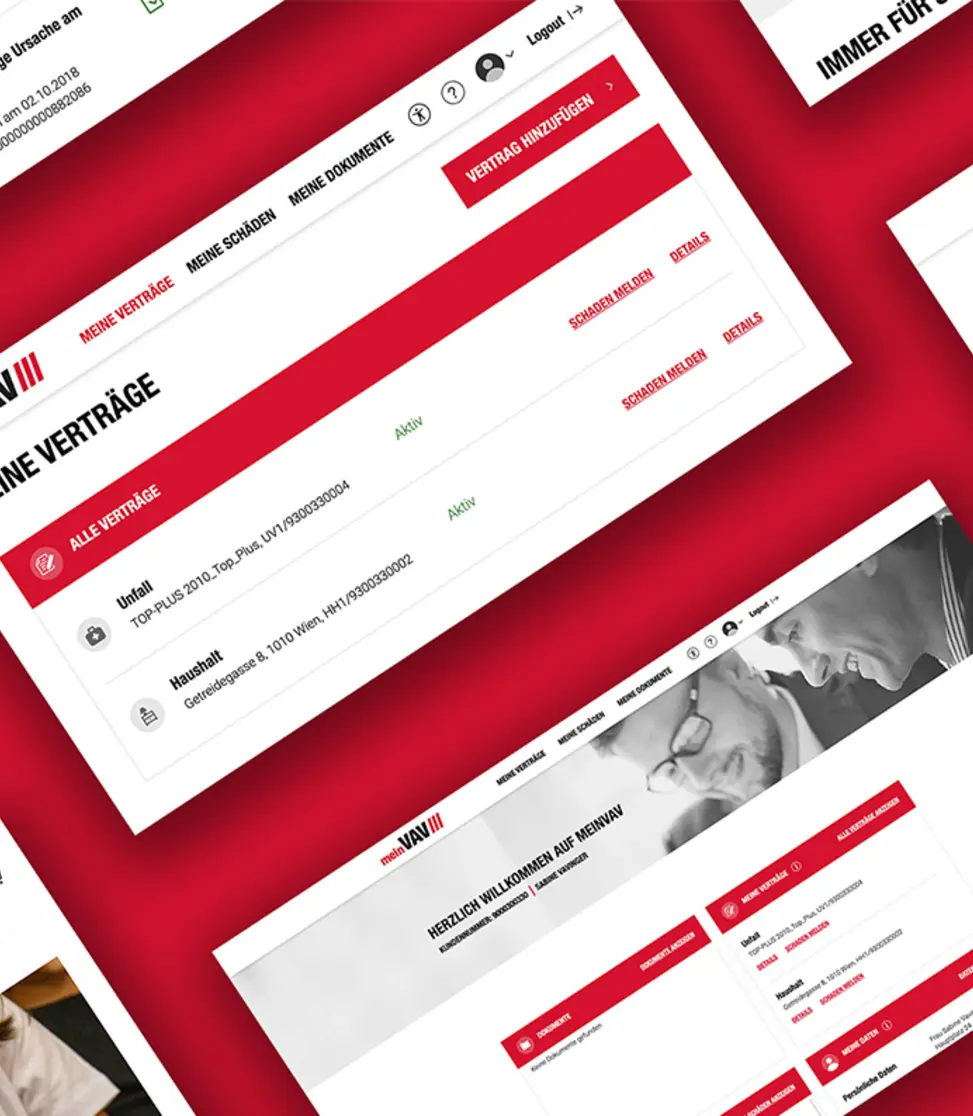

Mr Rabe: We focused on customer service at a very early stage. To start with, as a broker insurer, we did not have any regional offices, but rather regionally well-connected broker advisors who intensively take care of the brokers throughout Austria. Naturally, our sales partners know the practices of the insurance industry very well and therefore place the highest demands on our service. This special organisational structure has always required lean operational processes and procedures that are, at the same time, highly effective. This is why we relied on digital applications and contract conclusions very early on in our cooperation with brokers, but also in our online communication with end customers. We’ve also facilitated the online conclusion of contracts for more than ten years. As a result, we learned very early on how to automate our entire settlement process.

// What is the service advantage for your customers?

Mr Rabe: Our customers benefit from this in two ways. On the one hand in the form of lower internal costs, which in turn is reflected in the premium, and on the other hand through a high speed of service. One example of this is the fully automated processing of insurance applications, completely independent of the technical "flight path". Whether the application is submitted via the broker portal or online by the end customer, the IT systems are so sophisticated that all items are checked for plausibility and processed fully automatically - from the application to the processing to the conclusion with the dispatch of the contract documents to the customer or sales partner.

// Digitalisation is also considered a driving force for more customer orientation. Where specifically can it help with processes?

Mr Rabe: Wherever it’s advantageous for the customer, we use the potential of digitalisation across the entire range of our operational processes and procedures. This starts with the conclusion of contracts and extends far beyond claims processing. Many customers already expect to have their insurance policy in digital form and not have to fill and manage paper files at home. At VAV, we’ve been offering this for quite some time. We’re currently working on digitally managing the entire customer journey, which in insurance extends over many years, including claims settlement. This topic is occupying the entire industry. A number of issues still need to be resolved, such as how to digitalise non-value-adding steps in the claims process. But the decisive factor is that digitalisation must also make sense for the customer. The customer must benefit in terms of time if simple tasks are digitalised.

// VAV is one of the early movers in the digitalisation of the insurance business. How do you see the further development in this field?

Mr Rabe: We do indeed see ourselves as an early mover because, as a broker insurer, we naturally had a special interest in efficient processes and proper technical handling from the very beginning. However, customers, just like sales partners, have to enjoy using the computer or smartphone to communicate with us. They should be able to rely, for example, on the policy coming back quickly after their request. Last year, we introduced the so-called “instant policy” in all private segments: if we receive the application electronically, it’s processed within 20 seconds and the policy, along with the documents, goes to the customer electronically within a few seconds.

// That's what I call quick.

Mr Rabe: For our industry, that is, in fact, pretty fast. When I talk to people from other industries, however, I hear that they find this quite normal. In any case, we get very positive feedback from the market and from our distribution partners for the instant policy. It makes a difference to the customer whether he gets his policy in no time at all or whether he has to wait three weeks, as is the case with some companies. You can't really get any faster than that.

Herr Rabe: But we want to become even better. We’ve certainly reached a high level of automation in onboarding, i.e. in the field of application processing for new customers. In the field of claims automation, however, our entire industry is still at the beginning. Yet this is also much more complex, because every claim is ultimately individual. The assessment of the claim will certainly still be done manually for a little longer. But in the steps before and after, for example in the payment, there’s still a lot that can be automated.

// An additional challenge for your industry are the InsureTechs, aggressive start-ups that want to take away customers and revenues from the established insurers with new business models. How seriously do you take the new competitors?

„“This is certainly an area that is changing the market, making the wheels turn faster and accelerating innovation.”“

Mr Rabe: On the other hand, the InsureTechs probably won’t trigger a revolution on the product side. They sell standard products and are often somewhat better in terms of processes than many traditional insurers. However, unlike perhaps in other sectors, they don’t create new products. When it comes to designing processes, with all its modesty, VAV can certainly keep up with the FinTechs. We’ve been on the market for decades and have been working on these topics for a long time. This may also be due to the fact that insurance isn’t a retail product that can be designed a little better, just like that.

// Mr Rabe, as a manager of a large insurance company, dealing with risks is one of your core competencies. Will risks like the Corona virus be part of the "new normal" we have to learn to live with?

Mr Rabe: The tendency is certainly there. However, dealing with risks, even with larger risks, shouldn’t really be anything fundamentally new for an insurance company. After all, risks are part of our core business. It’s somewhat different with investments. As an enterprise, we now naturally have more risks on the assets side of the balance sheet. We’ve seen significantly higher volatility in investments for the past 10 to 15 years. Of course, this has to be managed with more focus and more actively. As far as insurance risks are concerned, we’re less worried because the industry has always managed these risks well. However, it’s also clear that not every risk is insurable, but that was also the case in the past.

// VAV Versicherung is characterised by a special feature. Unlike most other companies in the industry, it belongs to a mutual insurance association, which ultimately means the customers. Does this create a particularly customer-oriented corporate culture?

Mr Rabe: I’m convinced of that. As VAV Versicherung, we are part of the VHV Group, which celebrated its 100th anniversary last year. This stands for stability and continuity, reliability and financial strength. Nevertheless, we are, of course, also subject to market developments. But it’s precisely this modern topic of sustainability, which has also become increasingly important in the economy, that a mutual insurance company has, figuratively, practised for a hundred years.

// You are also not subject to quarterly reports like publicly listed stock corporations.

Mr Rabe: Therefore, we can operate in the long term and don’t depend on short-term success figures. This is a win-win situation, for the company and for the clients. We don't put profit first, but we don't put it last either. We’re able to tackle issues that require more staying power, issues that others aren’t willing or able to tackle. And, we don't pull out during "bad" phases and leave the client alone with the risk. We stay with our clients. This reliability is a real asset. We don’t pay dividends to shareholders; the money stays in the company. And a financially strong company is a reliable partner for its clients, especially when it comes to hedging risks

// Thank you very much for the interview and your time.